The Power of Outsource Bookkeeping for Your Business

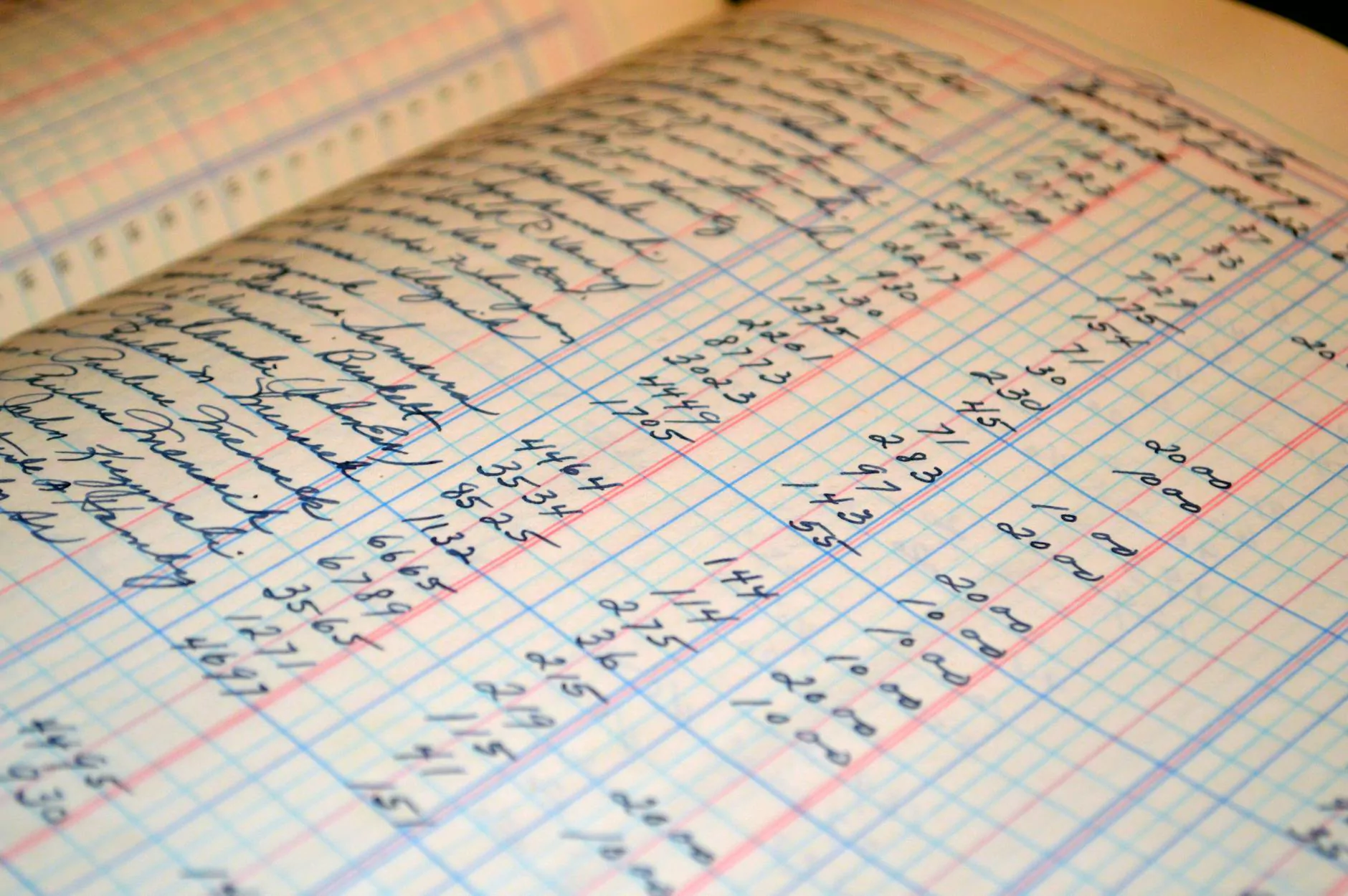

Outsource bookkeeping has been increasingly gaining popularity among businesses looking for a cost-effective and efficient way to manage their financial records. In today's fast-paced business environment, keeping track of finances in-house can be time-consuming and prone to errors. That's where outsource bookkeeping services come in to save the day.

Streamline Financial Services

By opting to outsource bookkeeping, businesses can streamline their financial services and focus on core activities that drive growth and profitability. Professional bookkeeping services offer expertise in managing financial transactions, keeping accurate records, and providing insights into the financial health of a business.

Improve Financial Advising

Outsourcing bookkeeping allows businesses to access expert financial advisors who can offer valuable insights and recommendations for improving financial performance. These advisors can help businesses make informed decisions, set financial goals, and plan for future growth.

Enhance Accounting Efficiency

Accountants play a crucial role in ensuring the accuracy and compliance of financial records. Outsource bookkeeping services provide access to skilled accountants who can handle complex accounting tasks efficiently, saving businesses time and resources.

Benefits of Outsource Bookkeeping

- Cost-Effectiveness: Outsourcing bookkeeping services can be more cost-effective than hiring an in-house team, as businesses only pay for the services they need.

- Expertise: Professional bookkeepers and accountants bring specialized knowledge and skills to the table, ensuring accurate and reliable financial records.

- Time-Saving: By outsourcing bookkeeping tasks, businesses can focus on core operations and strategic initiatives without getting bogged down in financial paperwork.

How Outsource Bookkeeping Works

Outsourcing bookkeeping involves partnering with a reputable financial services provider who handles all financial tasks on behalf of the business. This includes recording financial transactions, reconciling accounts, preparing financial statements, and more.

Choosing the Right Outsource Bookkeeping Partner

When selecting a bookkeeping service provider, businesses should consider factors such as industry experience, track record, compliance with regulations, and the ability to customize services to meet specific business needs. It's essential to choose a partner who can offer tailored solutions and support business growth.

Conclusion

Outsource bookkeeping services offer businesses a strategic advantage by enabling them to focus on their core competencies while leaving financial management to experts. By harnessing the power of professional bookkeeping, businesses can optimize efficiency, improve financial advising, and enhance accounting accuracy. Embrace the future of financial services with outsource bookkeeping!